ReadySetTrade Newsletter 10 march 2020

Opinion & Commentary

Progress towards beating out a short-term bottom; the S&P’s rallied hard overnight off of a lower low to open the cash session about 90 points higher. I’ve mentioned lately several times that we DON’T want to see an early rally in the day. The Bears took over, pushing the price all the way below yesterday’s closing price before a choppy rally kicked in. The Bulls woke up on cue, to post a 120 point rally into the closing bell. The ATR for the SPX is now sitting at a level of 97, which is the highest value in history. That makes sense, because prices are much higher than at any time in history. For comparison, today’s ATR of 97 is about 2.8% of the value where the crash started from, and the previous peak in 2008 of “63” was about 4.8% of the price where the crash started. .

Here are some data points for this corrective move so far:

- Correction: The S&P Futures have dropped 702.25 points from the February highs to show a 20.67% haircut in record time. The NASDAQ futures have fallen 1949 points or 19.96%, the DOW has fallen 6119 points or 20.71%, and the Russell 2000 has dropped 418.3 points or 24.58% off of the recent highs. These numbers are for the Futures and include after-hours highs/lows; the media is reporting <20% numbers but those are for the closing values on the cash indices.

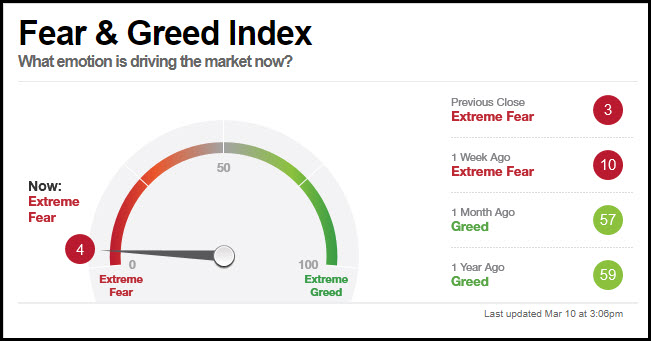

- Fear/Greed: The CNN Fear/Greed study was showing a value of 3 on 9 March; this is the lowest value that I’ve ever seen.

- VIX; The VIX topped out at 62.12 (9 march), exceeding the value seen in the early 2018 correction, and #2 only to the 2008 financial crisis.

- Volume: We’re seeing heavy volume but not the extreme levels of capitulation that we saw during the worst dates of the financial crisis.

- Circuit Breakers: Hit twice at 5% and 7% on 3/9/2020, first time during the cash market since October 27,1997..

Now what? In the past I’ve often found that we’ve gotten a bounce at the 10%/20% haircut levels. Today’s hammer candlestick was a great start, but there is often very tricky volatility around short-term bottoms and this one is not likely to be different.In today’s video I’ll discuss other market bottoms we’ve seen of late.

Market Technicals & Outlook

What is working right now? You’ve been taught forever to sell volatility spikes, but the REALIZED volatility is outpacing the IMPLIED volatility. It still does not pay to be a seller….yet.

What is working? Scalping the futures contracts. I will do some live video sessions from 0915a – 1000aET in the near future. Stay tuned to the discord area for announcements. If there is any interest in this style of trading, we’ll put more emphasis on it.

Very soon, there will be an enormous oversold relief bounce to the upside. It will come directly after a horrible low – perhaps even today’s – during which NO ONE will dare go long. We need to focus on keeping our head OUT of the mainstream media during this time as it will cost you money and opportunity if you do so. Just watch the price.

Watch these levels for the S&P “circuit breakers.”

Did you get signed up for the login to the Readyset.trade member’s login? Let me know at support (at) readyset.trade if you need the invite sent again.

Join the ReadySetTrade community online! Go to readyset.trade/discord to sign up!

My New Book is Available! – Fractal Energy Trading is now available on amazon.com for paperback or kindle!

Subscriber Update: Welcome to the “new” format and home of the newsletter at ReadySetTrade. What you see today is just the first step of many to bring you a new, active service. Look through your email for your password reset to access the “Member Home;” there is little there now, but we’ll be adding content like crazy in the coming weeks. If there is anything that you’d like to see me add to this newsletter, to the member knowledge base, or to the member community, please let me know by dropping me at line at doc (at) readyset.trade or support (at) readyset.trade.

Short-Term Outlook: We’ll be in a corrective pattern for several months as markets transition to sideways/volatile.

Offensive Coordinator

Offensive Actions for the next trading day:

- These are fat-tail, super-extreme conditions that offers little edge until stability returns. Cash is a position.

Defensive Coordinator

Defensive actions for the next trading day:

- I will look to clear my SPY 17APR put credit spreads for a $.20 debit on the next bounce higher.

- I will look to take profits on my SSO swing trade if the RSI(2) hits a value of 70 or higher.

Editor - Doc Severson

I believe that trading is a simple process, but we make it hard by being human. Understanding why we make the decisions that we do (neuroscience) is key to making the right decisions when the signals appear. We also need to root our analysis of the markets in the price action of the charts themselves, and not cloak them in a mask of trailing indicators. Reach out to me at support (at) readyset.trade if you have a question or comment.